European Online Gambling Market

- 10, 2020 (GLOBE NEWSWIRE) - The 'Europe Online Gambling Market - Growth, Trends, and Forecast (2020-2025)' report has been added to ResearchAndMarkets.com's offering.

- DUBLIN-(BUSINESS WIRE)-The 'Europe Online Gambling Market - Growth, Trends, and Forecast (2020-2025)' report has been added to ResearchAndMarkets.com's offering.The European online gambling.

Dublin, Dec. 09, 2019 (GLOBE NEWSWIRE) -- The 'Europe Online Gambling Market 2019' report has been added to ResearchAndMarkets.com's offering.

The European online gambling market is projected to grow, witnessing a CAGR of 9.20% during the forecast period (2020-2025). Growing hardware and software innovations and the rising popularity of casino and sports betting gambling, along with enhanced internet penetration, are expected to drive the growth of the European online gambling market.

Europe's Online Gambling Market Holds Strong

The report 'Europe Online Gambling Market 2019' highlights the strength of the European online gambling market.

Taking the largest share of the global online gambling market, Europe will continue its growth as a global market contributor. Legislation and legalization have played a role in this process, opening up more legal marketplaces for online gambling. Online gambling penetration in the EU is expected to grow through 2020, as quoted in the report.

Online gambling consistently makes up a larger share of the global gambling market year after year. Since 2016, global online gambling revenues have experienced double digit growth and this trend is set to persist through 2023, according to a statistic cited in the report. The European market adds a great deal of value to the overall global market and exhibits regular revenue growth as well.

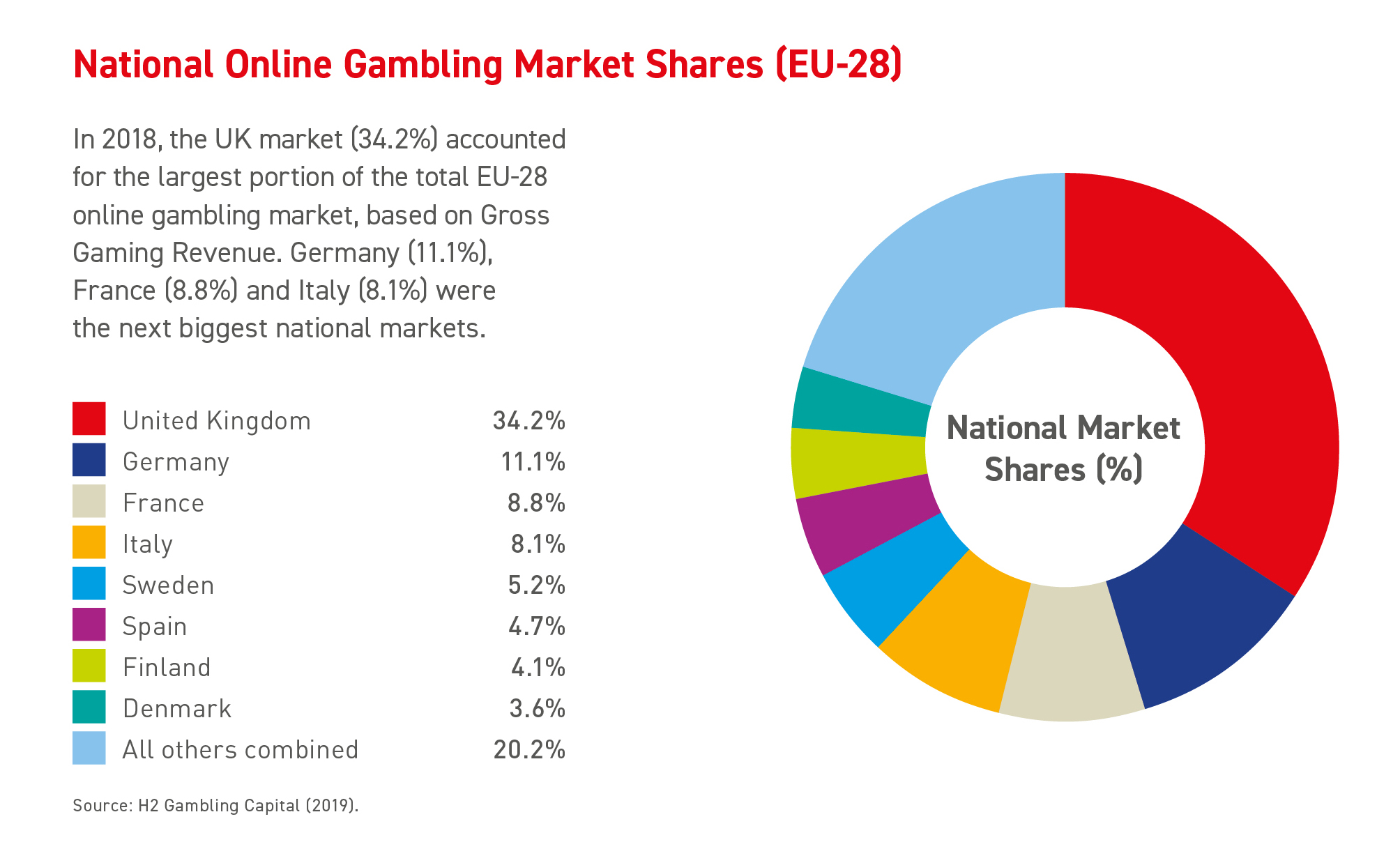

The United Kingdom is the largest and the most active market for online gambling in Europe. The British online gambling platform bet365 is also a market a leader in Germany, Italy, Spain, and Denmark, ousting local marketplaces in some countries. In terms of expansion, Italy and France's online gambling markets have been growing rapidly, in regards to numbers cited in the report.

Europe's role in the online gambling market

The global online gambling market's biggest player, Europe, will maintain its growth in the global marketplace. Through 2020, online gambling penetration is expected to rise across the EU.

Online gambling revenue exhibits persistent, high growth rates

Year after year, online gambling takes a larger portion of the overall global gambling market. Through 2023, double-digit revenue growth in the online gambling market will persist around the globe.

Europe's largest online gambling market contributors

The most engaged online gambling markets in Europe include the UK, Spain, Italy and others. Britain's bet365 platform is consistently a market leader among online gambling among these countries.

Questions Answered in this Report

- What is the forecast for the global online gambling and betting market revenues by 2023?

- How high is Europe's share of the global online gambling market?

- Who are the major players in the global online gambling market in Europe?

- Which are the leading sectors of online gambling across Europe?

- What are the main market trends affecting the development of online gambling in Europe?

Key Topics Covered:

1. Management Summary

2. Global Developments

Online Gambling Wagers, in USD billion, 2017, 2018e and 2022f

Online Gross Gambling Revenues, in EUR billion, and Penetration, in % of Total Gross Gambling Market Revenues, 2013 - 2023f

Breakdown of Online Gross Gambling Revenues, by Region, in %, 2017

3. Europe

3.1 Regional

Online Gambling Market Trends, January 2019

Online Gross Gambling Revenues, in EUR billion, 2017 - 2020f

Online Share of Total Gambling Revenues, in %, 2017 & 2020f

Breakdown of Online Gross Online Gambling Revenues by Activity, in %, 2017

3.2 UK

Remote Gambling Turnover and Gross Gambling Yield, in GBP million, by Segment and Total, April 2015 - March 2016, April 2016 - March 2017, April 2017 - March 2018

Share of the Remote Sector, in % of Total Gross Gambling Yield, April 2017-March 2018

Breakdown of Online Gambling Market Shares, by Selected Top Players, in % of Revenues, 2017

Top 5 Gambling Websites, incl. Total Website Visits, in millions, UK's Share of Total Visits, in %, Average Time Spent per Visit, and Bounce Rate, in %, December 2018

3.3 Germany

Gross Gambling Revenues by Segment, by Regulated and Non-Regulated Market, incl. Online, in EUR million, 2017

Top 5 Gambling Websites, incl. Total Website Visits, in millions, Germany's Share of Total Visits, in %, Average Time Spent per Visit, and Bounce Rate, in %, December 2018

3.4 France

Online Gross Gambling Revenues, in EUR million, 2015 - 2017

Share of Online Gambling, in % of Total Gross Gambling Revenues, 2017

List of Licensed Gambling Operators, incl. Website, January 2019

Top 5 Gambling Websites, incl. Total Website Visits, in millions, France's Share of Total Visits, in %, Average Time Spent per Visit, and Bounce Rate, in %, December 2018

3.5 Italy

Online Gambling Expenditure by Segment and Total, in EUR million, 2011 - 2017

Share of Online Gambling, in % of Total Gambling Expenditure, 2017

Mobile Gambling Expenditure, in EUR million, 2016 & 2017

Average Number of Monthly Active Online Gambling and Betting Users, in thousands, 2016 & 2017

Top 30 Operators in Online Casino by Market Share, in %, 2018

Top 30 Operators in Online Sports Betting by Market Share, in %, 2018

Top 5 Gambling Websites, incl. Total Website Visits, in millions, Italy's Share of Total Visits, in %, Average Time Spent per Visit, and Bounce Rate, in %, December 2018

3.6. Spain

Total Amount Played in Online Gambling and Betting, by Segment, in EUR million, 2016 - 2017, Q1-Q3 2018

Gross Gambling Revenues from Online Gambling and Betting, by Segment, in EUR million, 2016 - 2017, Q1-Q3 2018

Online Gambling Deposits, Withdrawals and Gross Gaming Revenue, in EUR million, 2013 - 2017, Q1-Q3 2018

List of Licensed Gambling Operators with Websites, January 2019

Top 5 Gambling Websites, incl. Total Website Visits, in millions, Spain's Share of Total Visits, in %, Average Time Spent per Visit, and Bounce Rate, in %, December 2018

3.7 Denmark

Online Casino Deposits, Winnings, Operator Commission and Gross Gaming Revenue, in DKK million, 2013 - 2017, Q1-Q3 2018

Breakdown of Gross Gambling Revenues from Online Casino Games by Mobile and Desktop/ Laptop, in %, September 2017- October 2018

Top 5 Gambling Websites, incl. Total Website Visits, in millions, Denmark's Share of Total Visits, in %, Average Time Spent per Visit, and Bounce Rate, in %, December 2018

European Online Gambling Marketing

3.8 Russia

Share of Online Betting Deposits, in % of Total Betting Deposits, 2018e

Breakdown of Preferred Betting Channels, in % of Men Who Make Sports Bets, 2018

Top 5 Gambling Websites, incl. Total Website Visits, in millions, Russia's Share of Total Visits, in %, Average Time Spent per Visit, and Bounce Rate, in %, December 2018

3.9 Norway

Number of Online Gambling Players, in thousands, 2016 & 2017

Breakdown of Devices Used for Online Gambling, in % of Players, 2017

Breakdown of Channels of Used for Online Gambling, by Local and Foreign, in % of Players, 2017

Top 5 Gambling Websites, incl. Total Website Visits, in millions, Norway's Share of Total Visits, in %, Average Time Spent per Visit, and Bounce Rate, in %, December 2018

3.10 Sweden

Services Purchased Online, in % of Internet Users, Q2 2018

Top 5 Gambling Websites, incl. Total Website Visits, in millions, Sweden's Share of Total Visits, in %, Average Time Spent per Visit, and Bounce Rate, in %, December 2018

3.11 Finland

Top 5 Gambling Websites, incl. Total Website Visits, in millions, Finland's Share of Total Visits, in %, Average Time Spent per Visit, and Bounce Rate, in %, December 2018

Online Share of Total Gambling Revenues of Veikkaus, in %, Q3 2018

Companies Mentioned

- 888 Holdings Ltd

- AB Svenska Spel

- Bet365 Group Ltd

- Danske

- Det Danske Klasselotteri A/S

- La Francaise Des Jeux S.A

- Lottomatica S.p.A.

- Norsk Tipping AS

- Pari Mutuel Urbain GIE

- Premier Lotteries Investments UK Limited

- Sisal S.p.A.

- Sociedad Estatal Loteras y Apuestas del Estado

- Spil A/S

- The Stars Group Inc.

- Tipico Co. Ltd.

- Veikkaus Oy

- fonbet.ru

- myscore.ru

- stoloto.ru

For more information about this report visit https://www.researchandmarkets.com/r/7wcf11

Research and Markets also offers Custom Research services providing focused, comprehensive and tailored research.

Earlier this year, experts made numerous predictions on the future of the gambling industry. Life, however, since stepped in and had its say, and the COVID-19 pandemic introduced itself to the world in the spring of 2020.

And now, forced quarantines continue to severely affect the income of casinos and sports bookmakers.

In any negative scenario, however, it is important to look for a silver lining. And we have already seen that the pandemic has created increased demand in some industries. The gambling industry, for example, is one that has seen more popularity than ever before. Even before the pandemic, there has been opportunities for recent developments in the online gambling industry to gain more exposure. One example of these developments has been live casino games, with live croupiers dealing and spinning the action from a real-world casino streamed directly to your computer.

The Effect of COVID-19 on the Online Gambling Scene

When the pandemic shook the world in March of this year, and numerous sporting events were cancelled, the online gambling industry began to see a change, i.e., a trend had occurred in that there was a rising statistic in new online casino players every week. This was brought about by the fact that sports betting fans had fewer events to bet on.

UK Online Casinos Leading the Charge

The UK has seen a paradigm shift, with the crossover from offline to online gambling given a huge boost to popular UK gawking sites. While many were enjoying gambling on their mobile devices, many who were stuck at home during the pandemic turned to their laptops and desktops. With no sign of the pandemic ending soon, we will likely see a greater number of gamblers satisfying their craving for casinos online.

Reports from UK Gambling Commission

Reports from the United Kingdom Gambling Commission (UKGC) verified a significant increase in those playing online. These reports claim a 25 per cent increase in people playing slots and a 38 per cent increase in poker playing. These numbers are for the first two months of COVID-19.

Online Migration at Peak

Us Online Gambling

Of course, it isn’t just gambling that’s been affected by the pandemic. People are working more at home, and even shopping and socialising more in front of their computer screen. Whether this is a sign of things to come remains to be seen. It will likely ensure, however, that people are more digitally aware and more comfortable interacting with the Internet than ever before.

The Future of Online Gambling in Europe

There is currently a boom in online gambling in Europe. This growth is often associated with “soft” zones, which is essentially a lighter tax regime with operators. These are regions such as the Isle of Man, Malta, and Gibraltar. Not only that, but the EU is also seeing positive development in virtual technologies: e-sports, VR gambling, VR slots, and VR casinos. Business owners in the gambling industry want to serve the contemporary player who do not visit mainstream clubs and casinos but instead prefer to use personal computers or gadgets.

As sports betting came to a partial standstill, bettors were looking for alternative methods to flex their gambling and entertainment muscles. This saw more people playing online slots or table games like poker.

The Final Word

The increased popularity of the online gambling industry and the restrictions on land-based casino activities as a result of the pandemic have led to offline establishments losing their appeal among players. Experts have argued that gambling operators who failed to bother to establish an online version of their products will struggle. Gambling is becoming an increasingly online activity, and that’s just a fact.